michigan use tax exemption form

Forms Tax exempt forms Tax forms United States Michigan Sales and Use Tax Exemption Certificate. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from the.

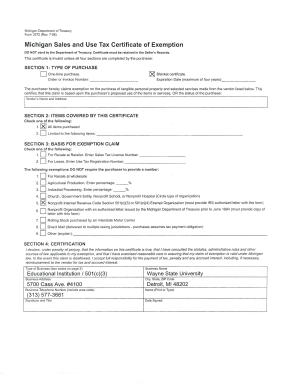

Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used to claim exemption from Michigan Sales and Use Tax.

. Ad Fill Sign Email MI DoT 3372 More Fillable Forms Register and Subscribe Now. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Apply for or renew permit or certification.

For other Michigan sales tax exemption certificates go here. Do Business with the City. Michigan Department of Treasury Form 3372 Rev.

It to the contractor who will submit this form to the supplier along with Michigans Sales and Use Tax Certificate of Exemption form 3372 at the time of. Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2. The state of Michigan has only one form which is intended to be used when you wish to purchase tax-exempt items such as prescription medicines.

The buyer must present the seller with a completed form at. Michigan defines industrial processing as the activity of converting or. This exemption application must be completed by the buyer provided to the seller.

Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied. Michigan Sales Tax Exemption This form is used to exempt the university from sales tax on purchases. Michigan Department of Treasury Form 3372 Rev.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. If you are looking to purchase goods in Michigan and you have tax-exempt status you need to fill out this form and present it to the. Certiicate must be retained in the.

Exemption entities may complete the. Michigan Department of Treasury 3372 Rev. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing.

The Michigan Sales and Use Tax. 8-09 Michigan Sales and Use Tax Certiicate of Exemption DO NOT send to the Department of Treasury. Most farm retail businesses simply have a location on the purchase.

Find or apply for employment. Authorized Representative DeclarationPower of Attorney. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on.

2020 Sales Use and Withholding 4 and 6 MonthlyQuarterly and Amended MonthlyQuarterly Worksheet. Get the tax answers you need. If you received a Letter of Inquiry Regarding Annual Return for the return period of 2020 visit MTO to file or access the 2020 Sales Use and Withholding Taxes Annual Return fillable form.

Producers are encouraged to complete this form and give to vendors when making exempt purchases. Ad Talk to a 1-800Accountant Small Business Tax expert. This box only if the property owner is.

It is used in conjunction with the IRS determination letter documenting the. Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used in claiming exemption from Michigan sales and use tax. We have the experience and knowledge to help you with whatever questions you have.

For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the. This page discusses various sales tax exemptions in Michigan. Apply for or renew license.

If you received a Letter of Inquiry Regarding Annual Return for the return period of 2021 visit MTO to file or 2021 Sales Use and Withholding Taxes Annual Return to access the fillable form. 7-05 Michigan Sales and Use Tax Certificate of Exemption TO BE RETAINED IN THE SELLERS RECORDS - DO NOT SEND TO TREASURY. Ad Create Edit Sign a Tax Exempt Certificate Today - Start By 915.

A Michigan resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. 11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury. Certificate must be retained in the.

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Michigan State Tax Form Fill Online Printable Fillable Blank Pdffiller

2022 Form 5076 Small Taxpayer Exemption Thornapple Twp

Tax Exempt Form Wayne State University

Sales And Use Tax Regulations Article 3

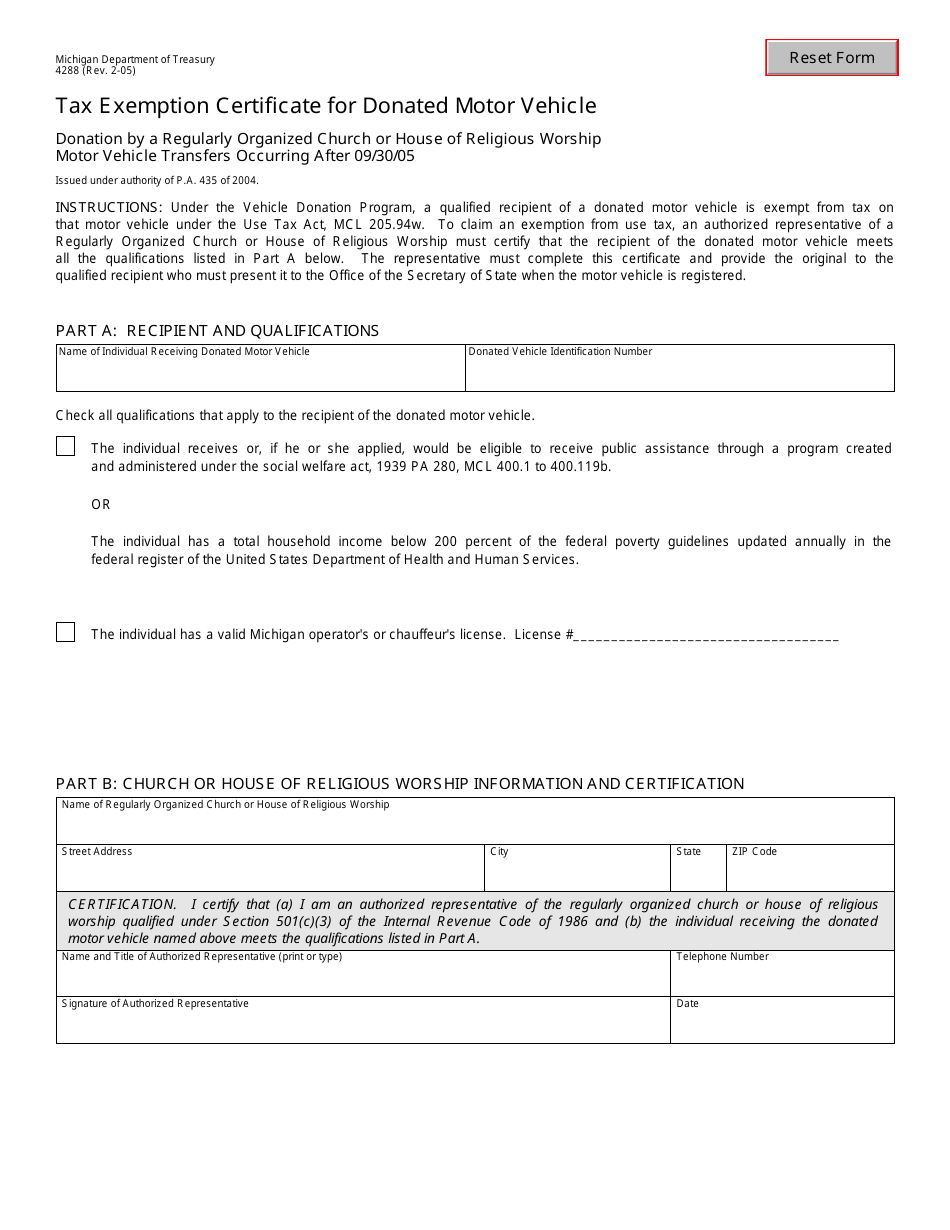

Form 4288 Download Fillable Pdf Or Fill Online Tax Exemption Certificate For Donated Motor Vehicle Michigan Templateroller

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller